Successful HDD businesses typically share a set of general traits: a deep talent base at key skilled positions, a culture of hard work, a strong team mentality and highly efficient equipment.

But truly elite operations have one additional trait: a knack for uncovering tools that maximize the return on every dollar invested. That’s why Section 179 is a popular tool employed by elite HDD operations. Section 179 offers several strategic operational advantages:

- Shrink equipment replacement cycles;

- Facilitate more aggressive technology upgrades;

- Reduce operating expenses associated with running inefficient and outdated equipment;

- Lower capital expenditures.

Click section179.org to learn more about the Section 170 Tax Deduction.

Wildly popular in the HDD industry, Section 179 is typically used to boost operational efficiency and as a strategic tool for entering new markets.

Section 179 – The Details

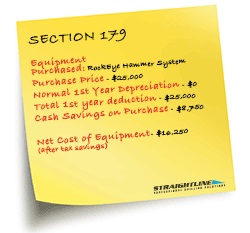

Last December, Congress passed into law the Section 179 Tax Deduction for business. The law expands the Section 179 limit to $500,000, with additional benefits of bonus depreciation for amounts over $500,000. The law provides a compelling incentive for HDD operators’ to acquire equipment needed to drive efficiency and productivity.

Subject to certain limitations, the Section 179 deduction allows businesses to deduct the full purchase price of qualifying purchases (rather than depreciate over a number of years) from their gross income. Qualifying equipment is broadly defined, including HDD rigs & equipment, business-use vehicles, mud systems, air hammers, etc. Generally, any serial numbered good is considered a whole good.

Here’s the “catch”: Any equipment purchased under Section 179 must be purchased and put into service by December 31, 2016, to qualify.

Click here to access a Section 179 calculator: https://www.crestcapital.com/tax_deduction_calculator

Many Section 179 buyers are looking at used equipment to stretch their capital equipment purchases further.

The Bottom Line

Over the last couple years, Congressional “foot-dragging” led to uncertainty and triggered a mad scramble at the end of the year to purchase and deploy equipment by the December 31 deadline. Only the most nimble operators were able to capitalize.

Unlike last year’s last minute passage, Section 179 is already on the books. With uncertainty eliminated, savvy contractors are already working to develop strategies for using the law to put more revenue-producing equipment in service.

NOTE: This article is for informational purposes only and does not represent tax and/or legal advice. Always consult a tax professional to determine how you can benefit from Section 179.